- Global (EN)

- Albania (en)

- Algeria (fr)

- Argentina (es)

- Armenia (en)

- Australia (en)

- Austria (de)

- Austria (en)

- Azerbaijan (en)

- Bahamas (en)

- Bahrain (en)

- Bangladesh (en)

- Barbados (en)

- Belgium (en)

- Belgium (nl)

- Bermuda (en)

- Bosnia and Herzegovina (en)

- Brasil (pt)

- Brazil (en)

- British Virgin Islands (en)

- Bulgaria (en)

- Cambodia (en)

- Cameroon (fr)

- Canada (en)

- Canada (fr)

- Cayman Islands (en)

- Channel Islands (en)

- Colombia (es)

- Costa Rica (es)

- Croatia (en)

- Cyprus (en)

- Czech Republic (cs)

- Czech Republic (en)

- DR Congo (fr)

- Denmark (da)

- Denmark (en)

- Ecuador (es)

- Estonia (en)

- Estonia (et)

- Finland (fi)

- France (fr)

- Georgia (en)

- Germany (de)

- Germany (en)

- Gibraltar (en)

- Greece (el)

- Greece (en)

- Hong Kong SAR (en)

- Hungary (en)

- Hungary (hu)

- Iceland (is)

- Indonesia (en)

- Ireland (en)

- Isle of Man (en)

- Israel (en)

- Ivory Coast (fr)

- Jamaica (en)

- Jordan (en)

- Kazakhstan (en)

- Kazakhstan (kk)

- Kazakhstan (ru)

- Kuwait (en)

- Latvia (en)

- Latvia (lv)

- Lebanon (en)

- Lithuania (en)

- Lithuania (lt)

- Luxembourg (en)

- Macau SAR (en)

- Malaysia (en)

- Mauritius (en)

- Mexico (es)

- Moldova (en)

- Monaco (en)

- Monaco (fr)

- Mongolia (en)

- Montenegro (en)

- Mozambique (en)

- Myanmar (en)

- Namibia (en)

- Netherlands (en)

- Netherlands (nl)

- New Zealand (en)

- Nigeria (en)

- North Macedonia (en)

- Norway (nb)

- Pakistan (en)

- Panama (es)

- Philippines (en)

- Poland (en)

- Poland (pl)

- Portugal (en)

- Portugal (pt)

- Romania (en)

- Romania (ro)

- Saudi Arabia (en)

- Serbia (en)

- Singapore (en)

- Slovakia (en)

- Slovakia (sk)

- Slovenia (en)

- South Africa (en)

- Sri Lanka (en)

- Sweden (sv)

- Switzerland (de)

- Switzerland (en)

- Switzerland (fr)

- Taiwan (en)

- Taiwan (zh)

- Thailand (en)

- Trinidad and Tobago (en)

- Tunisia (en)

- Tunisia (fr)

- Turkey (en)

- Turkey (tr)

- Ukraine (en)

- Ukraine (ru)

- Ukraine (uk)

- United Arab Emirates (en)

- United Kingdom (en)

- United States (en)

- Uruguay (es)

- Uzbekistan (en)

- Uzbekistan (ru)

- Venezuela (es)

- Vietnam (en)

- Vietnam (vi)

- Zambia (en)

- Zimbabwe (en)

- Financial Reporting View

- Women's Leadership

- Corporate Finance

- Board Leadership

- Executive Education

Fresh thinking and actionable insights that address critical issues your organization faces.

- Insights by Industry

- Insights by Topic

KPMG's multi-disciplinary approach and deep, practical industry knowledge help clients meet challenges and respond to opportunities.

- Advisory Services

- Audit Services

- Tax Services

Services to meet your business goals

Technology Alliances

KPMG has market-leading alliances with many of the world's leading software and services vendors.

Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. That’s why KPMG LLP established its industry-driven structure. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients.

- Our Industries

How We Work

We bring together passionate problem-solvers, innovative technologies, and full-service capabilities to create opportunity with every insight.

- What sets us apart

Careers & Culture

What is culture? Culture is how we do things around here. It is the combination of a predominant mindset, actions (both big and small) that we all commit to every day, and the underlying processes, programs and systems supporting how work gets done.

Relevant Results

Sorry, there are no results matching your search..

- Topic Areas

- Reference Library

Handbook: Equity method of accounting

Handbooks | December 2024

Latest edition: Our in-depth equity method of accounting guide, providing examples and analysis.

Using Q&As and examples, KPMG provides interpretive guidance on equity method investment accounting issues in applying ASC 323. This December 2024 edition incorporates updated guidance and interpretations.

Applicability

- All companies with equity method investments

Relevant dates

- Effective immediately

Still standing

The FASB has made sweeping changes in the last two decades to the accounting for investments in consolidated subsidiaries and equity securities. However, it has left the accounting for equity method investments largely unchanged since the Accounting Principles Board released APB 18 in 1971.

The Accounting Principles Board developed the equity method with the view that its one-line consolidation premise would “best [enable] investors…to reflect the underlying nature of their investment[s].”

Notwithstanding that some have advocated eliminating the equity method of accounting, its principles have remained intact – often bending, but not yet breaking – as the capital markets evolve. New and unique investment structures often challenge those principles and push the profession to make critical judgments about their application in today’s financial reporting environment.

Our objective with this publication is to help you make those critical judgments. We provide you with equity method basics and expand on those basics with insights, examples and perspectives based on our years of experience in this area. We navigate scope, deconstruct initial measurement, and examine subsequent measurement – including how to analyze complex capital structures, demystify dilution transactions and outline presentation, disclosure and reporting considerations.

Report contents

- Initial recognition and measurement

- Recognizing investee activity

- Recognizing investor-level adjustments

- Changes in ownership and degree of influence

- Presentation and disclosure

Download the document:

Equity method

Explore more

Handbook: Consolidation

Latest edition: Our in-depth consolidation guide, covering variable interest entities, voting interest entities and NCI.

Handbook: Business combinations

Latest edition: Our in-depth guide to accounting for acquisitions of businesses, updated for recent application issues.

FASB clarifies accounting for certain equity method investments

ASU 2020-01 clarifies the interactions between ASC 321, ASC 323 and ASC 815.

Simplified investor accounting for tax equity investments

FASB issues final ASU that expands use of the proportional amortization method to additional tax equity investments.

Meet our team

Subscribe to stay informed

Receive the latest financial reporting and accounting updates with our newsletters and more delivered to your inbox.

Choose your subscription (select all that apply)

By submitting, you agree that KPMG LLP may process any personal information you provide pursuant to KPMG LLP's Privacy Statement .

Accounting Research Online

Access our accounting research website for additional resources for your financial reporting needs.

Thank you for contacting KPMG. We will respond to you as soon as possible.

Contact KPMG

Job seekers

Visit our careers section or search our jobs database.

Use the RFP submission form to detail the services KPMG can help assist you with.

Office locations

International hotline

You can confidentially report concerns to the KPMG International hotline

Press contacts

Do you need to speak with our Press Office? Here's how to get in touch.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

12.3 Accounting for Investments by Means of the Equity Method

Learning objectives.

At the end of this section, students should be able to meet the following objectives:

- Describe the theoretical criterion for applying the equity method to an investment in stock and explain the alternative standard that is often used.

- Compute the amount of income to be recognized under the equity method and make the journal entry for its recording.

- Understand the handling of dividends that are received when the equity method is applied and make the related journal entry.

- Indicate the impact that a change in fair value has on the reporting of an equity method investment.

- Prepare the journal entry to record the sale of an equity method security.

Question: Not all investments in corporate stock are made solely for the possibility of gaining dividends and share price appreciation. As mentioned earlier, The Coca-Cola Company holds 35 percent ownership of Coca-Cola Enterprises. The relationship between that investor and investee is different. The investor has real power; it can exert some amount of authority over the investee. The Coca-Cola Company owns a large enough stake in CCE so that operating and financing decisions can be influenced . When one company holds a sizable portion of another company, is classifying and accounting for the investment as an available-for-sale or trading security a reasonable approach?

Answer: The answer to this question depends on the size of ownership. As the percentage of shares grows, the investor gradually moves from having little or no authority over the investee to a position where significant influence can be exerted. At that point, the investment no longer qualifies as a trading security or an available-for-sale security. Instead, the shares are reported by means of the equity method . The rationale for holding the investment has changed.

The equity method views the relationship of the two companies in an entirely different fashion. The accounting process applied by the investor must be altered. Consequently, a note to the 2008 financial statements prepared by The Coca-Cola Company states, “We use the equity method to account for our investments for which we have the ability to exercise significant influence over operating and financial policies. Consolidated net income includes our Company’s proportionate share of the net income or net loss of these companies.”

The equity method is applied when the investor has the ability to apply significant influences to the operating and financing decisions of the investee. Unfortunately, the precise point at which one company gains that ability is impossible to ascertain. A bright line distinction simply does not exist. Although certain clues such as membership on the board of directors and the comparative size of other ownership interests can be helpful, the degree of influence is a nebulous criterion. When a question arises as to whether the ability to apply significant influence exists, the percentage of ownership can be used to provide an arbitrary standard.

According to U.S. GAAP, unless signs of significant influence are present, an investor owning less than 20 percent of the outstanding shares of another company reports the investment as either a trading security or available-for-sale security. In contrast, an investor holding 20 percent or more but less than or equal to 50 percent of the shares of another company is assumed to possess the ability to exert significant influence. Unless evidence is present that significant influence does not exist, the equity method is applied by the investor to report all investments in this 20–50 percent range of ownership.

Link to multiple-choice question for practice purposes: http://www.quia.com/quiz/2092970.html

Question: One company holds shares of another and has the ability to apply significant influence so that the equity method of accounting is appropriate . What reporting is made of an investment when the equity method is used? What asset value is reported on the owner’s balance sheet and when is income recognized under this approach?

Answer: When applying the equity method, the investor does not wait until dividends are received to recognize profit from its investment. Because of the close relationship, the investor reports income as it is earned by the investee. If, for example, a company reports net income of $100,000, an investor holding a 40 percent ownership immediately records an increase in its own income of $40,000 ($100,000 × 40 percent). In recording this income, the investor also increases its investment account by $40,000 to reflect the growth in the size of the investee company.

Income is recognized by the investor immediately as it is earned by the investee. Thus, it cannot be reported again when a subsequent dividend is collected. That would double-count the impact. Income must be recognized either when earned by the investee or when later distributed to the investor, but not at both times. The equity method uses the earlier date rather than the latter. Eventual payment of a dividend shrinks the size of the investee company. Thus, the investor decreases the investment account when a dividend is received if the equity method is applied. No additional income is recorded.

Companies are also allowed to report such investments as if they were trading securities. However, few have opted to make this election. If chosen, the investment is reported at fair value despite the degree of ownership with gains and losses in the change of fair value reported in net income.

Question: In applying the equity method, income is recognized by the investor when earned by the investee. Subsequent dividend collections are not reported as revenue by the investor but rather as a reduction in the size of the investment account to avoid including the income twice .

To illustrate, assume that Big Company buys 40 percent of the outstanding stock of Little Company on January 1, Year One, for $900,000. No evidence is present that provides any indication that Big lacks the ability to exert significant influence over the financing and operating decisions of Little. Thus, application of the equity method is appropriate. During Year One, Little reports net income of $200,000 and pays a total cash dividend to its stockholders of $30,000 . What recording is appropriate for an investor when the equity method is applied to an investment?

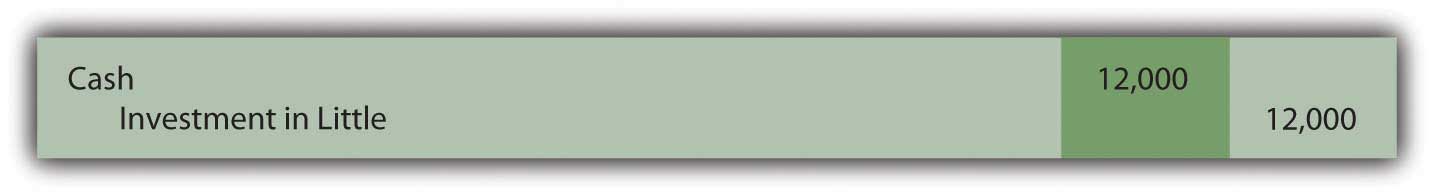

Answer: The purchase of 40 percent of Little Company for cash is merely the exchange of one asset for another. Thus, the investment is recorded initially by Big at its historical cost.

Figure 12.11 Acquisition of Shares of Little to Be Reported Using the Equity Method

Ownership here is in the 20 to 50 percent range and no evidence is presented to indicate that the ability to apply significant influence is missing. Thus, according to U.S. GAAP, the equity method is applied. Big recognizes its portion of Little’s $200,000 net income as soon as it is earned by the investee. As a 40 percent owner, Big accrues income of $80,000. Because earning this income caused Little Company to grow, Big increases its investment account to reflect the change in the size of the investee.

Figure 12.12 Income of Investee Recognized by Investor Using the Equity Method

Big has recognized the income from this investee as it was earned. Consequently, any eventual dividend received from Little is a reduction in the investment in Little account rather than a new revenue. The investee company is smaller as a result of the cash payout. The balance in this investment account rises when the investee reports income but then falls (by $12,000 or 40 percent of the total distribution of $30,000) when that income is later passed through to the stockholders.

Figure 12.13 Dividend Received from Investment Accounted for by the Equity Method

On Big’s income statement for Year One, investment income—Little is shown as $80,000. Because the equity method is applied, the reader knows that this figure is the investor’s ownership percentage of the income reported by the investee.

At the end of Year One, the investment in Little account appearing on Big’s balance sheet reports $968,000 ($900,000 + 80,000 – 12,000). This total does not reflect fair value as with investments in trading securities and available-for-sale securities. It also does not disclose historical cost. Rather, the $968,000 asset balance is the original cost of the shares plus the investor’s share of the investee’s subsequent income less any dividends received. Under the equity method, the asset balance is a conglomerate of numbers.

Link to multiple-choice question for practice purposes: http://www.quia.com/quiz/2092971.html

Question: Assume, at the end of Year One, after the above journal entries have been made, Big sells all of its shares in Little Company for $950,000 in cash . When the equity method is applied to an investment, what is the appropriate recording of an eventual sale?

Answer: An investment reported using the equity method quickly moves away from historical cost as income is earned and dividends received. After just one year, the asset balance reported above by Big has risen from $900,000 to $968,000 (income of $80,000 was added and $12,000 in dividends were subtracted). If these shares are then sold for $950,000, a loss of $18,000 is recognized.

Figure 12.14 Sale of Investment Reported Using the Equity Method

If these shares had been sold for more than their $968,000 carrying value, a gain on the sale is recorded.

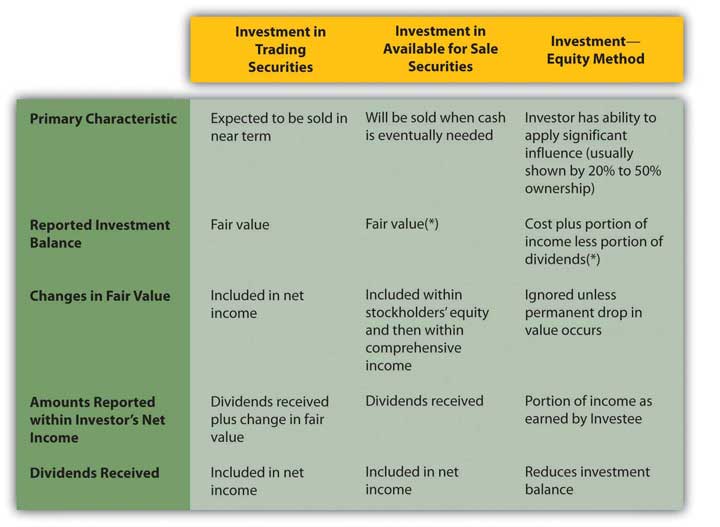

Summary . All investments in the stock of another company—where ownership is no more than 50 percent—must be accounted for in one of three ways depending on the degree of ownership and the intention of the investor.

Figure 12.15 Comparison of Three Methods to Account for Investments

*At the time of acquisition, an investor has the option of accounting for investments that are available for sale or investments where the ability to apply significant influence is present by the same method as that used for trading securities.

Link to multiple-choice question for practice purposes: http://www.quia.com/quiz/2092992.html

Link to multiple-choice question for practice purposes: http://www.quia.com/quiz/2093013.html

Key Takeaway

At some point, an owner can gain enough equity shares of another company to have the ability to apply significant influence. Use of the equity method then becomes appropriate. Significant influence is difficult to gauge so ownership of 20–50 percent of the outstanding stock is the normal standard applied in practice. However, if evidence is found indicating that significant influence is either present or does not exist, that takes precedence regardless of the degree of ownership. Under the equity method, income is recognized by the investor as soon as earned by the investee. The investment account also increases as a result of recognizing this income. Conversely, dividends are not reported as income but rather as reductions in the investment balance. Unless a permanent decline occurs, fair value is not taken into consideration in accounting for an equity method investment. When sold, the book value of the asset is removed so that any difference with the amount received can be recognized as a gain or loss.

Financial Accounting Copyright © 2015 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

- Search Search Please fill out this field.

What Is the Equity Method of Accounting?

- How It Works

- Revenue and Asset Changes

Alternative Methods

The bottom line.

- Corporate Finance

Equity Method of Accounting: Definition and Example

:max_bytes(150000):strip_icc():format(webp)/JBJHeadshot-JanetBerry-Johnson-238498f91a144bf082ed759d0b1c86a8.jpg)

The equity method is an accounting technique used to record the profits earned by a company through its investment in another company .

Under the equity method of accounting, the investor company reports the revenue earned by the other company on its income statement . This amount is proportional to the percentage of its equity investment in the other company.

Key Takeaways

- The equity method of accounting is a technique used to record the profits earned by a company through its investment in another company.

- The equity method is generally used when a company holds significant influence over the company it is investing in.

- The investment is initially recorded at historical cost, and adjustments are made to the value based on the investor ’s percentage ownership in net income, loss, and dividend payouts.

- Net income of the investee company increases the investor’s asset value on their balance sheet, while the investee’s loss or dividend payout decreases it.

- The investor also records the percentage of the investee’s net income or loss on their income statement.

Paige McLaughlin / Investopedia

Understanding the Equity Method

The equity method is the standard technique used when one company, the investor, has a significant influence over another company, the investee. When a company holds approximately 20% or more of a company’s stock, it is considered to have significant influence.

Significant influence means that the investor company can impact the value of the investee company, which in turn benefits the investor. As a result, the change in value of that investment must be reported on the investor’s income statement .

Companies with less than 20% interest in another company may also hold significant influence, in which case they also need to use the equity method. Significant influence is defined as an ability to exert power over another company. This power includes representation on the board of directors , involvement in policy development, and the interchanging of managerial personnel.

Owning 20% or more of the shares in a company doesn’t automatically mean that the investor exerts significant influence. Operating agreements, ongoing litigation, or the presence of other majority stockholders may indicate that the investor doesn’t exert significant influence and that the equity method of accounting is inappropriate.

Recording Revenue and Asset Changes Under the Equity Method

The equity method acknowledges the substantive economic relationship between two entities. The investor records their share of the investee’s earnings as revenue from investment on the income statement. For example, if a firm owns 25% of a company with a $1 million net income, the firm reports earnings from its investment of $250,000 under the equity method.

When the investor has a significant influence over the operating and financial results of the investee, this can directly affect the value of the investor’s investment. The investor records their initial investment in the second company’s stock as an asset at historical cost. Under the equity method, the investment’s value is periodically adjusted to reflect the changes in value due to the investor’s share in the company’s income or losses. Adjustments are also made when dividends are paid out to shareholders.

Using the equity method, a company reports the carrying value of its investment independent of any fair value change in the market. With a significant influence over another company’s operating and financial policies, the investor is basing their investment value on changes in the value of that company’s net assets from operating and financial activities and the resulting performances, including earnings and losses.

For example, when the investee company reports a net loss, the investor company records its share of the loss as “loss on investment” on the income statement, which also decreases the carrying value of the investment on the balance sheet .

When the investee company pays a cash dividend, the value of its net assets decreases. Using the equity method, the investor company receiving the dividend records an increase to its cash balance but reports a decrease in the carrying value of its investment. Other financial activities that affect the value of the investee’s net assets should have the same impact on the value of the investor’s share of investment. The equity method ensures proper reporting on the business situations for the investor and the investee, given the substantive economic relationship they have.

Example of the Equity Method

Assume, for example, that ABC Co. purchases 25% of XYZ Corp. for $200,000. At the end of year one, XYZ Corp. reports a net income of $50,000 and pays $10,000 in dividends to its shareholders. At the time of purchase, ABC Co. records a debit of $200,000 to “Investment in XYZ Corp.” (an asset account) and a credit in the same amount to cash.

At the end of the year, ABC Co. records a debit of $12,500 (25% of XYZ’s $50,000 net income) to “Investment in XYZ Corp.,” and a credit in the same amount to Investment Revenue. In addition, ABC Co. records a debit of $2,500 (25% of XYZ’s $10,000 dividends) to cash, and a credit in the same amount to “Investment in XYZ Corp.” The debit to the investment increases the asset value, while the credit to the investment decreases it.

The new balance in the “Investment in XYZ Corp.” account is $210,000. The $12,500 Investment Revenue figure will appear on ABC’s income statement, and the new $210,000 balance in the investment account will appear on ABC’s balance sheet. The net ($197,500) cash paid out during the year ($200,000 purchase - $2,500 dividend received) will appear in the cash flow from / (used in) investing activities section of the cash flow statement.

When an investor company exercises full control—generally over 50% ownership—over the investee company, it must record its investment in the subsidiary using a consolidation method. All revenue, expenses, assets, and liabilities of the subsidiary would be included in the parent company ’s financial statements.

On the other hand, when an investor does not exercise full control or have significant influence over the investee, they would need to record their investment using the cost method. In this situation, the investment is recorded on the balance sheet at its historical cost.

Is an Investment in Another Company the Same As an Acquisition?

One company can invest in another at any amount, and it is not always considered an acquisition. It is considered an acquisition if a company buys most or all of another company’s shares (50% or more) because the investor has effectively gained control of the investment company. However, an investor company can still exert significant influence even if it owns less than 50% of the investee’s shares.

What Is the Difference Between the Equity Method and the Cost Method?

Under the equity method of accounting, dividends are treated as a return on investment. They reduce the value of the investor’s shares. The cost method of accounting, however, treats dividends as taxable income.

What Are the Advantages of Using the Equity Method?

Using the equity method of accounting provides a more complete and accurate picture of the economic interest that one company (the investor) has in another (the investee). This allows for more complete and consistent financial reports over time and gives a more accurate picture of how the investee’s finances can impact the investor’s.

When one company holds a significant investment in another, usually 20% or more, the investor company must use the equity method of accounting to report that investment on its income statement. This is done because holding significant shares in a company gives an investor company some degree of influence over the company’s profit, performance, and decisions. As a result, any profit or loss from the investment is recorded as profit or loss to the company itself.

The investment is first recorded at its historical cost, then adjusted based on the percent ownership that the investor has in net income, loss, and any dividend payments. Net income increases the value on the investor’s income statement, while both loss and dividend payouts decrease it.

PwC, Viewpoint. “ 12.8 Equity Method .”

Association of International Certified Professional Accountants. “ Determining ‘Significant Influence’ for Equity Method Investees: It’s Not Just Owning 20% of the Stock ,” Pages 3–4.

Association of International Certified Professional Accountants. “ Determining ‘Significant Influence’ for Equity Method Investees: It’s Not Just Owning 20% of the Stock ,” Pages 4–5.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-175599141-2ce72850981343a9ade6410691182453.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Holiday Sale – 40% Off All Online Courses

- The Investment Banker Micro-degree

- The Project Financier Micro-degree

- The Private Equity Associate Micro-degree

- The Research Analyst Micro-degree

- The Portfolio Manager Micro-degree

- The Restructurer Micro-degree

- Fundamental Series

- Asset Management

- Markets and Products

- Corporate Finance

- Mergers & Acquisitions

- Financial Statement Analysis

- Private Equity

- Financial Modeling

- Try for free

- Pricing Full access for individuals and teams

- View all plans

- Public Courses

- Investment Banking

- Investment Research

- Equity Research

- Professional Development for Finance

- Commercial Banking

- Data Analysis

- Team Training

- Felix Continued education, eLearning, and financial data analysis all in one subscription

- Learn more about felix

- Publications

- Online Courses

- Classroom Courses

- My Store Account

- Learning with Financial Edge

- Certification

- Masters in Investment Banking MSc

- Find out more

- Diversity and Inclusion

- The Investment banker

- The Private Equity

- The Portfolio manager

- The real estate analyst

- The credit analyst

- Felix: Learn online

- Masters Degree

- Public courses

- Login to Felix

Test Yourself

Sign up to access your free download and get new article notifications, exclusive offers and more.

Featured Product

Equity method investments.

By Financial Edge Team |

October 1, 2020

What are “Equity Method Investments”?

Companies use the equity method to report their profits earned through investments in other companies. The investor company will report the revenue earned by the investee company in its income statement, with the percentage of the equity investment in the investee company.

Investor companies will use the equity method to report their investments in the investee company when they have:

- Significant influence but not control.

- Exception – if the investor company owns 55% but anti-trust issues prevent it from having control.

- Exception – if you have a board veto and own 45%, then you would probably fully consolidate.

The investor company would report the investment as a one-line consolidation – one line on the income statement, balance sheet and cash flow statement. The investment on the balance sheet would reflect at the original cost, then retained earnings would be added over time. In most cases, the balance sheet does not reflect the fair value of the investment.

Key Learning Points

- Equity method investments are strategic purchases of equity in another business where the investor has significant influence but not control in the investee company (usually 20%-50%)

- The investor must use the equity method to report these types of investments in their financial statements

- Equity method investments are reported as a one-line consolidation item in the investor’s income statement, balance sheet and cash flow statement

- When the investment is made it is recognized as a non-current asset; the subsequent financing accounts (cash for example) must go down by the purchase amount

- Income generated by the investment is included in the investor’s income statement (at their % share) as well as the retained earnings account and the investment asset

- A dividend payment by the investment will result in the investor’s cash balance increasing by their share of dividend received and a corresponding decrease in the asset

Equity Method Accounting Example

Nestle owns a 23.2% stake in L’Oreal, which is treated as an equity method investment:

On the income statement is a one-line called “Income from Associates and Joint Ventures”. The line is below tax and shown net of taxes. So Nestle’s share of income from equity method investments (which is largely L’Oreal) is 916MM.

On the balance sheet, a long-term asset shows the original purchase price plus any reinvested earnings to date:

The notes to the accounts provide more detail:

For L’Oreal, the 2018 year started with 8,184MM and Nestle then added its share of L’Oreal’s net income of 1,044MM (this number is different than the 919MM on the income statement as there were other associates and JVs, some of which were lossmaking so Nestle took their share of the other company’s losses). When Nestle receives dividends from L’Oreal these are deducted from the investment and added to the cash balance.

On the cash flow statement, the equity income of 1,044MM is subtracted in the cash flow from operations, and usually, the dividends received are added to the cash flow from operations (there is scope under IFRS to add the dividends received to the cash flow from investing activities).

Accounting Entries

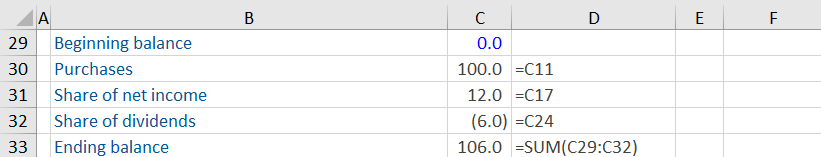

Company A buys 20.0% of the equity of Company B from the shareholders of Company B for 100.0 in an all cash deal. What are the impacts on Company A’s financial statements as a result of this deal?

Company B records net income of 60.0 after tax:

Company B pays dividends of 30.0:

Points to Note

- Company A reduces its cash with $100 million and shows its investment in Company B.

- Although Company B earned $60 million net income, Company A only reports 20% of that in their books since that is their investment in Company B.

- When Company B declared a dividend of $30 million, Company A reported only $6 million since they are entitled to 20% of that.

- Company A increased their cash with the dividend amount ($6 million) but decreased their equity investment since they received the dividend from Company B. If they had increased their investment, they would be double-counting.

The dividend accounting is confusing as many people want to put the 6.0MM in dividends into the income statement. However, Company A has already taken 12.0MM to the income statement – its share of net income, taking the dividends as well, would be double counting.

Remember, when a public company pays a dividend its stock price drops. So, we reflect the decrease in equity value by deducting the dividend from the equity method investment.

Share this article

- Start Hiring Remote

About Vintti

We're a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%.

Need to Hire?

We’ll match you with Latin American superstars who work your hours. Quality talent, no time zone troubles. Starting at $9/hour.

I hope you enjoy reading this blog post.

If you want my team to find you amazing talent, click here

What is Equity Method Accounting?

Written by Santiago Poli on Dec 21, 2023

Readers likely agree that accounting for equity investments can be complex.

This article clearly explains the equity method of accounting , including key concepts, differences from other methods, and real world examples.

You will learn the fundamentals of equity method accounting , from initial recording to subsequent measurement and adjustments. We compare the equity method to the cost method, cover tax and international accounting implications, reporting requirements, and provide illustrative case studies.

Introduction to Equity Method Accounting

The equity method is an important accounting technique used by companies to reflect their investment in other entities. It is applied when an investor has significant influence over the investee company. This introduction provides an overview of the equity method and why it matters for accurate financial reporting .

Understanding the Equity Method

The equity method is an accounting approach whereby the investment is initially recorded at cost but is then adjusted periodically to reflect the investor's share of the investee's profits or losses. The key steps are:

- The investment is first recorded at acquisition cost

- The investor's share of the investee's profits increase the investment (as income)

- The investor's share of any dividends received from the investee reduce the investment

- Any adjustments to reflect the investor's share of the investee's losses also reduce the investment

So under the equity method, the investment account reflects both the initial cost and the post-acquisition change in the investor's share of net assets of the investee.

Criteria for Using the Equity Method

The equity method applies when an investor has 'significant influence' over the investee. Significant influence generally means the investor holds 20-50% of the voting shares.

Specific criteria for applying the equity method include:

- Owning 20-50% shareholding/voting rights in the investee

- Having significant representation on the investee's board of directors

- Being party to significant transactions with the investee

- Possessing essential technical information relied on by the investee

If the investor's stake is less than 20%, the investment is accounted for at fair value. And ownership above 50% leads to full consolidation.

Goals of the Article

This article aims to help readers understand key aspects of equity method accounting. It will cover:

- The mechanics of how the equity method works

- When the equity method is required under accounting standards

- How to calculate and record equity method journal entries

- Differences between the equity method and other accounting for investments

With this foundation, readers should gain competence in applying the equity method in practice.

Is equity method accounting the same as cost?

No, the equity method and cost method of accounting for investments are not the same. Here are some key differences:

- Accounting Treatment : The equity method records the initial investment at cost and adjusts the carrying value of the investment based on the investor's share of the investee's income, losses, and dividends. The cost method records the investment at cost with dividends treated as income.

- Income Recognition : Under the equity method, the investor recognizes its share of the investee's net income or loss in its income statement. The cost method only recognizes dividends received as income.

- Asset Value : The equity method investment balance on the balance sheet reflects the initial cost adjusted for the investor's share of income/losses and reduced by dividends. The cost method investment balance only changes if there is an additional investment or full/partial write-down.

So in summary, the key difference is the equity method dynamically accounts for the investor's share of the investee's earnings while the cost method does not. The choice of accounting depends on the level of influence - equity method for significant influence, cost method for no/low influence.

What is the equity method of accounting?

The equity method of accounting is an accounting technique used by investors to account for investments in which they have significant influence over the investee company but do not fully control it.

Some key things to know about the equity method:

- It applies when an investor owns 20-50% of the voting shares of the investee company

- The investor's share of the investee's net income or net loss is recorded on the income statement

- The investor's share of other comprehensive income items is recorded directly in equity

- The investment balance on the investor's books is adjusted periodically to reflect their share of income/losses and dividends paid

So in essence, under the equity method, the investor is recording their share of the profits or losses of the investee company. This gives a more accurate picture of the investor's income compared to other methods like the cost method.

The equity method has implications for the investor's financial statements and ratios. For example, return on equity (ROE) will be impacted because net income includes the investor's share of the investee's income. Care must be taken when analyzing financial statements of a company using the equity method.

Some key differences between the equity method and the cost method of accounting for investments include:

- Cost method: Does not account for periodic income/losses. Only impacts investor books when dividends are paid or impairment charge is recorded.

- Equity method: Investor books reflect periodic investee income/losses. More accurate picture of investment performance.

In summary, the equity method provides a better accounting view compared to other methods when an investor owns 20-50% and has significant influence over the investee company. Understanding the mechanics and implications of this method is important for accurate financial analysis .

How do you explain equity in accounting?

Equity represents the residual value of a company's assets after subtracting all liabilities. It reflects the net worth or book value that would be returned to shareholders if the company was liquidated and all debts paid off.

There are a few key things to know about equity in accounting:

- Equity = Assets - Liabilities : This basic accounting equation shows that equity is equal to everything the company owns (assets) minus everything it owes (liabilities).

- It's a measure of residual ownership : Equity holders have a residual claim on assets after creditors get paid. So equity represents the shareholders' stake in the company based on initial investments and any retained earnings.

- It's increased by profits/investments : Equity grows when a company makes profits (which boost retained earnings) or receives cash investments from shareholders (which increases contributed capital).

- It's decreased by losses/dividends : On the flip side, equity shrinks if a company takes losses or pays dividends to shareholders from retained earnings.

So in summary, equity essentially reflects owner's funds in the business. It's a core accounting concept that connects a company's funding from owners and its residual assets after settling debts. Tracking equity is vital to assess the net worth and health of a business over time.

What is equity method versus consolidation?

The main difference between the equity method and consolidation is the level of ownership and control a company has over the investment.

Equity Method Key Points:

- Used when a company owns between 20-50% of another company's stock

- The investment is initially recorded at cost

- The investor's share of the investee's profits and losses are recognized in the income statement and added to/deducted from the investment account

- Only the investor's proportional share of the investee's earnings are recognized - there is no line-by-line consolidation

Consolidation Key Points:

- Used when ownership exceeds 50%

- Entails fully combining the financial statements of the two entities

- All assets, liabilities, revenues and expenses are combined on a line-by-line basis

- Intercompany balances and transactions are eliminated

- Non-controlling interest is reported for portions not owned

In summary, the equity method is simpler, only recording proportional earnings. Consolidation offers full control and requires detailed combination of accounts, including elimination entries. The 50% ownership threshold determines which method a company should apply for its investments.

Fundamentals of Equity Method Accounting

Equity method accounting is used to account for investments in associates or joint ventures. It requires the investor to recognize its share of the investee's net income or loss in the income statement, and its share of other comprehensive income in equity.

Equity Method Investment Basics

The equity method is applicable when an investor has significant influence over the investee. Significant influence usually means the investor owns 20-50% of the voting shares.

The key steps in equity method accounting are:

- Record initial investment at cost

- Adjust carrying amount each period for the investor's share of income, losses and distributions

- Report investor's share of income or loss in income statement

- Report share of other comprehensive income in equity

Equity Method Accounting Journal Entries

Here are some common journal entries under the equity method:

Initial investment

Subsequent share of income

Share of loss

Share of other comprehensive income

Cash distribution received

Equity Method Formula

The formula to calculate an investor's share of income or loss is:

Investor's Share of Income = Investee's Net Income x Investor Ownership Percentage

For example, if the investee reports net income of $100,000 and the investor owns 30% of the voting shares, the investor's share of income would be $30,000 ($100,000 x 30%).

The equity method carrying amount on the balance sheet is adjusted each period to reflect the investor's share of income or losses and any distributions received.

Initial Recognition and Measurement

Recording the initial investment.

When a company purchases an equity investment that gives them significant influence over the investee, they account for the investment using the equity method. To initially record the investment, the investing company makes a debit to an asset account such as Investments in Affiliates for the purchase price paid for the investee's shares. They will also credit Cash to reduce their cash balance by the amount paid.

For example, if Company A purchases 30% ownership in Company B for $300,000, the journal entry would be:

This records the initial equity method investment at cost on Company A's books.

Determining the Cost of Investment

The cost of an equity method investment includes the amount paid for the investee's stock as well as any direct costs related to acquiring the investment. This initial cost establishes the investment account's beginning balance.

Direct acquisition costs may include:

- Investment banking fees

- Accounting fees

- Valuation fees

For example, if Company A paid $300,000 for shares of Company B plus $10,000 in legal fees, the initial cost basis would be $310,000.

The initial cost forms the basis for calculating the periodic equity method income or loss to be recognized by the investor. Understanding the composition of the initial cost is important for properly accounting for the investment over time.

sbb-itb-beb59a9

Subsequent measurement and adjustments.

Equity method investments are adjusted over time to reflect the investor's share of the investee's profits and losses. This helps account for changes in the value of the investment.

Profit and Loss Recognition

The investor records its share of the investee's net income or loss as investment income on its income statement. The amount recognized is based on the percentage ownership in the investee. For example, if the investor owns 30% of the investee, it recognizes 30% of the investee's net income or loss.

The investment account on the investor's balance sheet is also adjusted each period. The carrying amount of the investment is increased by the investor's share of the investee's income, or decreased by the investor's share of the investee's losses.

Adjustments for Dividends and Other Distributions

Cash dividends or other distributions received from the investee reduce the carrying amount of the investment on the investor's books. This properly reflects that a portion of the investment has been returned to the investor in the form of dividends.

For example, if the investor receives a $100,000 cash dividend and currently has a $1,000,000 carrying value for the investee investment, the carrying value would be reduced to $900,000 to reflect the return of capital.

Impairment Considerations

Equity method investments must be evaluated each reporting period to assess whether impairment indicators are present. Common indicators include operating losses by the investee or other significant events that negatively impact the investee's fair value.

If impairment exists, the investor must calculate its share of the impairment loss and record an impairment charge to reduce the carrying amount of the investment. Ongoing operating losses may require recording additional impairment charges in subsequent periods.

Equity Method vs Cost Method

The equity method and cost method are two different accounting approaches for valuing investments in other entities. The key differences between them are:

Differences in Recognition and Measurement

- The equity method recognizes the initial investment at cost and adjusts the carrying value based on the investor's share of the investee's income, losses and dividends. The investor's share of the investee's earnings and losses are recognized in the income statement.

- The cost method records the initial investment at cost and only recognizes income from the investment to the extent dividends are received. The investee's earnings and losses are not recognized by the investor.

Under the equity method, the investment asset is adjusted periodically to reflect the investor's share of the investee's earnings or losses. This causes the investment balance to fluctuate over time. Under the cost method, the investment remains at the acquisition cost amount on the balance sheet unless dividends are received or impairment is recognized.

Impact on Financial Statements

The different approaches can have the following impacts on the investor's financial statements:

- Income Statement - As noted above, the equity method investment flows the investor's share of the investee's net income/loss into the income statement each period. The cost method only recognizes dividend income received, so earnings may be more volatile under the equity method.

- Balance Sheet - The investment account balance fluctuates under the equity method but generally remains static under cost method, except for dividends and impairments.

- Cash Flow Statement - Cash flows between the investor and investee are reflected differently. Under the equity method, these are mostly operating cash flows. Under the cost method, dividends received are investing cash inflows.

So in summary, the equity method shows the investor's share of the investee's performance while the cost method does not. This can impact earnings trends, balance sheet presentation, and cash flow classification.

Tax Implications of Equity Method Investments

Equity method investment tax treatment.

The equity method of accounting has important tax considerations. While the investor company reports its share of the investee's net income on its income statement, this income may not be taxable.

Some key points on the tax treatment of equity method investments:

- The investor generally does not recognize taxable income from an equity method investment until dividends are received. This creates a deferred tax asset/liability related to the investment.

- Differences between income for accounting purposes and tax purposes lead to temporary differences. This includes undistributed earnings of investees.

- Tax implications depend on whether the investment is in a corporation or flow-through entity like a partnership. Flow-through income may be currently taxable.

- Gains and losses on the sale of an equity method investment receive capital or ordinary tax treatment depending on the specifics.

Proper tax planning and tracking of differences between accounting income and taxable income are important when using the equity method. Consultation with a tax advisor is recommended.

Deferred Taxes and Equity Method

The use of the equity method often results in deferred tax assets or liabilities on the balance sheet of the investor. This occurs due to timing differences between when net income is recognized for accounting purposes versus when it becomes taxable.

Some examples include:

- Undistributed earnings: The investor has income for accounting purposes but has not yet received taxable dividends. This creates a deferred tax liability.

- Excess distributions: If more dividends are distributed than cumulative equity earnings, this leads to a deferred tax asset.

- Impairments: An impairment write-down creates a deductible temporary difference and deferred tax asset.

Tracking differences between book and tax income is essential. The equity method investor needs procedures to estimate:

- Income expected to be undistributed each period

- Income expected to be distributed in future periods

- Any impairment write-downs for accounting purposes that are deductible for tax purposes

By accurately estimating deferred tax impacts, the proper accounting can be achieved. This leads to correct tax provision and balance sheet presentation.

International Accounting Standards: Equity Method of Accounting IFRS

The equity method is an accounting approach for certain investments whereby the investment is initially recorded at cost but is subsequently adjusted based on the investor's share of the investee's profits or losses. The equity method serves as a middle ground between consolidating the investee's financial statements and accounting for the investment based solely on its fair value.

Under IFRS, the equity method is applied when the investor has significant influence over the investee. Significant influence is presumed with a shareholding between 20-50%, unless it can be clearly demonstrated not to exist.

IFRS Requirements for Equity Method

The key requirements for applying the equity method under IFRS are:

- The investor must have significant influence over the investee, generally established with a 20-50% ownership interest.

- The investment must be classified as an associate or joint venture on acquisition.

- The equity method is applied from the date significant influence arises until the date it ceases.

- The investor's share of the investee's post-acquisition profits or losses is recognized in profit or loss.

- Distributions received from the investee reduce the carrying amount of the investment.

- Adjustments to the carrying amount may also be required for changes in the investee’s equity.

Comparing IFRS and US GAAP Equity Accounting

While IFRS and US GAAP have similar principles for equity method accounting, some key differences include:

- Ownership threshold: IFRS uses 20-50% to indicate significant influence while US GAAP uses 20% or greater.

- Classification: IFRS differentiates between an "associate" and a "joint venture" whereas US GAAP refers only to "equity method investments."

- Impairment testing : IFRS requires testing equity method investments for impairment. US GAAP has no such requirement.

- Presentation: IFRS requires separate presentation of equity method earnings and dividends. US GAAP allows a choice of presentation.

So in summary, while the fundamental mechanics are similar between IFRS and US GAAP, IFRS provides more definitive guidance on significant influence and classification and requires specific impairment testing and presentation of equity method investees.

Reporting and Disclosure Requirements

Equity method investments have specific reporting and disclosure requirements under accounting standards. These ensure transparency and allow financial statement users to properly evaluate a company's investment holdings.

Financial Statement Presentation

When a company uses the equity method to account for an investment, the investment asset is presented as a single line item called "Investments in Equity Method Investees" on the balance sheet.

On the income statement, the investor's share of the investee's net income or loss is presented as a single line item called "Equity in Earnings/Losses of Investee".

These single line presentations simplify the financial statements while still providing insight into the performance of equity method investments.

Note Disclosures

Under the equity method, companies must disclose additional details about equity method investments in the notes to the financial statements.

Typical disclosures include:

- The name and percentage ownership of each equity method investee

- The accounting policies used by the investee to generate financial information

- Summarized financial information about each investee, including assets, liabilities, and net income

- The difference between the carrying amount of each investment and the investor's share of the investee's net assets

- The unrealized gains/losses recognized from the investee's earnings

These disclosures provide transparency into the details of a company's equity method investments that are not apparent on the face of the financial statements. They give financial statement users a clearer picture of the economics and performance of these types of investments.

Real-World Examples of Equity Method Accounting

Equity method accounting can be complex, but analyzing real-world examples helps illustrate the key concepts. Here are some case studies and lessons learned from companies applying the equity method.

Case Studies

Company A invested $1 million for a 40% stake in Company B . Here is how Company A accounted for this investment:

- Recorded $1 million investment on its balance sheet under Investments

- As Company B earns income, Company A records 40% of that income on its income statement under Income from Equity Method Investments

- The investment balance on Company A's balance sheet is adjusted (upwards or downwards) periodically to reflect Company A's share of Company B's income/losses

For example, if Company B earned $200,000 in the first year:

- Company A would record $80,000 (40% x $200,000) as income that year

- The $1 million investment would be adjusted to $1.08 million on Company A's balance sheet

This shows how the equity method allows the investing company to recognize its share of the income from its investment.

Company C used the equity method to account for its 30% investment in Company D , which was experiencing losses. Here is how the accounting worked:

- Company C originally invested $500,000 for a 30% stake in Company D

- In the first year, Company D had losses of $100,000

- Company C recorded 30% of those losses or $30,000 on its income statement

- The $500,000 investment was reduced to $470,000 on Company C's balance sheet

This example demonstrates how the equity method handles losses - the investor's share of losses reduces the carrying value of the investment on their balance sheet.

Lessons Learned

Key takeaways from real-world equity method accounting:

- It allows investors to recognize income/losses from investments where they have significant influence

- The investment balance sheet amount fluctuates over time as the investee's income/losses are recorded

- Both profits (income) and losses reduce the investment account balance

- Careful tracking of percentages owned, income, losses, dividends is needed

Seeing the equity method used in practice helps clarify exactly how this accounting treatment works. The examples illustrate the underlying concepts and mechanics.

Conclusion: Synthesizing the Equity Method

Key takeaways.

The equity method is an important accounting technique for investments when an investor has significant influence over the investee. Key takeaways include:

- The equity method is used when an investor owns 20-50% of the voting shares of an investee. This indicates significant influence over the investee's operations.

- Under the equity method, the investment account is increased/decreased to recognize the investor's share of the investee's income/losses.

- The investor's share of the investee's profits increases the investment account. The investor's share of losses decreases the investment account.

- Equity method accounting better reflects the investor's interest in the investee compared to the cost method or fair value method.

- Complex aspects include how to account for dividends, impairments, disposals, indirect ownership structures, and equity method journal entries.

Final Thoughts

The equity method is an important technique in accounting for investments. It is commonly applied when an investor owns a significant stake in an investee, demonstrating influence over financial and operating policies. Equity method accounting leads to a more accurate representation on the balance sheet and income statement from period to period. While complex in practice, the underlying principles help account for an investor's share of income/losses in the ongoing operations of an investee.

Related posts

- Accrued Revenue vs Accrued Expenses

- Equity Method Investments: Impairment Testing

- Equity Method Investments: Accounting for Joint Ventures

- How to Calculate Owner's Equity in QuickBooks

Looking to hire? We'll help you find the best talent.

See how we can help you find a perfect match in only 20 days. Interviewing candidates is free!

Looking for help? we help you hire the best talent

You can secure high-quality South American for around $9,000 USD per year. Interviewing candidates is completely free ofcharge.

Related articles

Accounting Jobs of the Future: How Staffing Agencies Can Help Land Them

Looking to stay ahead in the evolving world of accounting? Learn about emerging trends and how staffing agencies can help you secure top accounting jobs of the future.

These are the Best 5 Practices for Hiring Virtually

Discover the top 5 best practices for successful accounting talent offshoring. Optimize your operations and achieve seamless collaboration.

How to Write Letters of Engagement for Bookkeepers

How to craft effective letters to build trust, set clear expectations, and enhance client relationships in bookkeeping.

Find the talent you need to grow your business

You can secure high-quality South American talent in just 20 days and for around $9,000 USD per year.

COMMENTS

The presentation in Example FSP 10-1 is consistent with the presentation requirements of S-X-5-03. S-X 5-03 generally requires equity method earnings to be presented below the income tax line unless a different presentation is justified by the circumstances.

Multiple equity method investments can be aggregated for purposes of presentation on the balance sheet. In addition, a reporting entity may combine an investment in common stock with advances or investments in senior or other securities of an investee in a single amount for purposes of balance sheet presentation; however, disclosure of the ...

However, it has left the accounting for equity method investments largely unchanged since the Accounting Principles Board released APB 18 in 1971. The Accounting Principles Board developed the equity method with the view that its one-line consolidation premise would “best [enable] investors…to reflect the underlying nature of their ...

Nov 29, 2016 · This document discusses the equity method of accounting for investments. It covers several key points: 1. The equity method is used when an investor has significant influence over an investee, usually through owning 20-50% of the investee's voting stock. 2. Under the equity method, the investment is initially recorded at cost.

Answer: An investment reported using the equity method quickly moves away from historical cost as income is earned and dividends received. After just one year, the asset balance reported above by Big has risen from $900,000 to $968,000 (income of $80,000 was added and $12,000 in dividends were subtracted).

Aug 22, 2024 · The equity method of accounting is a technique used to record the profits earned by a company through its investment in another company. The equity method is generally used when a company holds ...

At that point, the equity method ceases to be applicable and the fair-value method is subsequently used. D. Reporting the sale of an equity investment 1. The investor applies the equity method until the disposal date to establish a proper book value. 2. Following the sale, the equity method continues to be appropriate if enough shares

Oct 1, 2020 · Equity method investments are reported as a one-line consolidation item in the investor’s income statement, balance sheet and cash flow statement When the investment is made it is recognized as a non-current asset; the subsequent financing accounts (cash for example) must go down by the purchase amount

Dec 21, 2023 · When a company uses the equity method to account for an investment, the investment asset is presented as a single line item called "Investments in Equity Method Investees" on the balance sheet. On the income statement, the investor's share of the investee's net income or loss is presented as a single line item called "Equity in Earnings/Losses ...

Apr 12, 2023 · Initial Measurement of Equity Method Investments. The equity method requires an investor to record its investment initially at cost (ASC 323-10-30-2 and ASC 805-50-30). An investor, however, may have a “basis difference” between the cost of its investment and the underlying equity in the net assets of an acquired investee.